225 days to go: Kick-starting investor outreach & pitch practice

A recap of week two as a full-time Founder

Hey there 👋🏾,

First of all, a big thank you to everyone that has read my newsletter so far — two weeks in and my posts have been read 1,000 times, which is a huge milestone 🥳. Hopefully that’s a sign that sharing a play-by-play of Mane Hook-Up’s funding round is helping people.

Last week, I shared a recap of my wins, losses and lessons learned but quickly realised there are a tonne of resources and tricks I’m picking up along the way that don’t quite fit into those categories. So, as of this week, I’m including a resources and major hack section to share more practical advice and info.

Here are the sections of the newsletter you may want to skip ahead to…

Win🏅: Creating an investor outreach system using Google Sheets & Wokaba CRM

Hack💥: How to find investors contact details on Crunchbase (without paying a penny)

Resources 📚: List of the top 100 Angel investors in the UK and Google sheets template I created for investor outreach

As always, I appreciate feedback so feel free to leave comments or reply to this email with your thoughts.

🎯 Objective

Kick-start investor outreach and pitch practice

Week two done, 225 days to go and it was another week with plenty to share. To keep myself on the straight and narrow, I went into the week with two objectives:

Kick-start investor outreach and create a systemised approach to doing this (as it will be a weekly task)

Start practising my pitch and deck run-through to collect as much advice from people as possible

With my routine in place (and adjustments made based on the previous weeks’ lessons), this was my first working week to really get stuck into fundraising work.

The upside, it was a super productive week and I have double the amount to share (literally… this newsletter is double the length of the last).

So… get comfortable. 🐸☕

🔋 Progress recap & highlights

Biggest wins

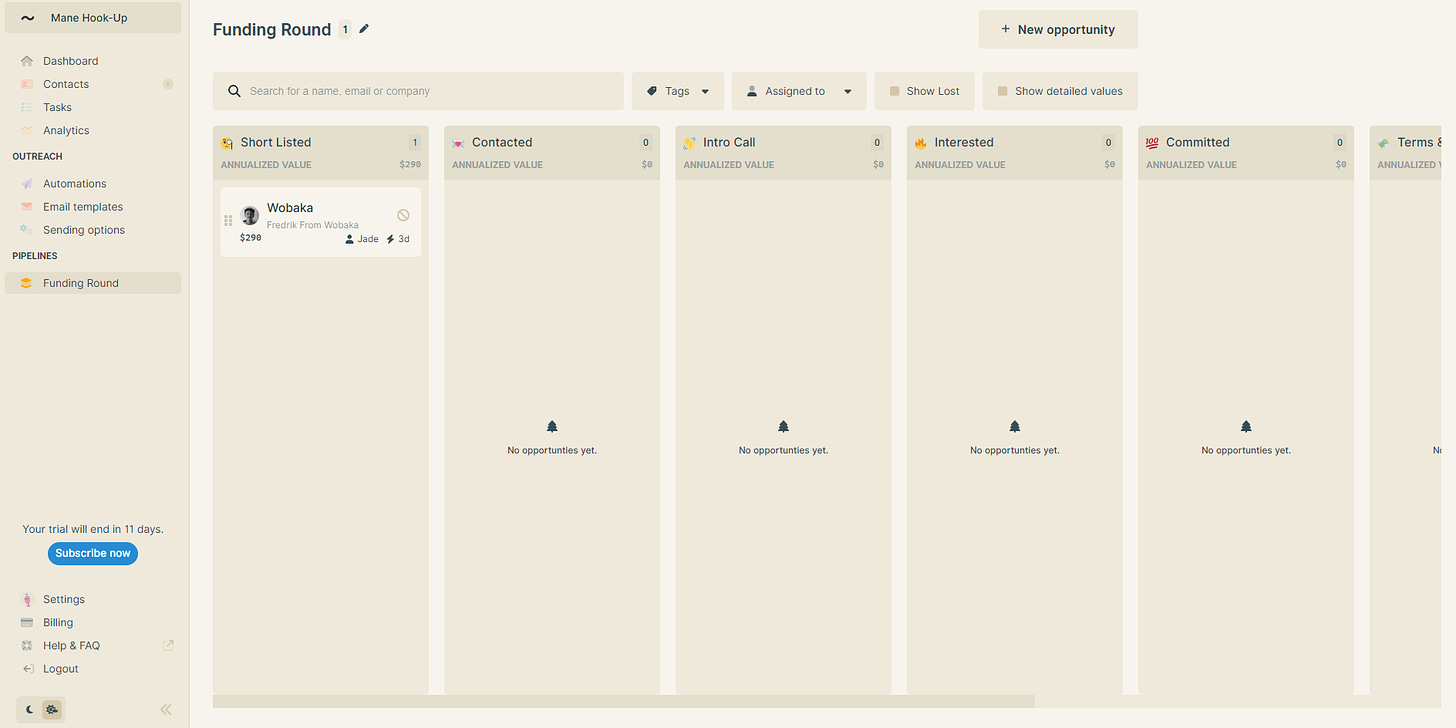

WIN 1️⃣: Created an investor outreach system using Google Sheets & Wobaka CRM ✅

After doing some back-of-the-napkin math, I estimated that I need to speak to 100-120 people to end up with 3-4 Angels who commit to investing in Mane Hook-Up. Having this number is helpful on two fronts:

I have an objective for the number of people to speak to (which can be broken down into weekly and monthly targets)

It forces me to create a system for outreach so I don’t miss a beat and follow up with investors in a timely way that keeps Mane Hook-Up front of mind.

With that in mind, I created a spreadsheet — template available in the new resources section — with a list of:

All the investors that I’m interested in speaking to,

Who (if anyone) I know is connected with them, and

A score 1-3 to help me prioritise outreach (scores based on their experience, past investments and likelihood of offering help/support)

It took a few days of digging around online in places like LinkedIn, Crunchbase and articles with lists of investors, to build up a list, but I now have 130 Angels to reach out to.

The final phase of this process was creating a system that allowed me to stay on top of investor outreach and create a high-level view of the size of each potential deal. A friend of mine recommended using a CRM and I agreed that would be the best way to keep track of everyone that I’m speaking to.

For those who don’t know, a CRM is a customer relationship management system. They’re typically used by sales teams to keep track of customers, orders and conversations.

Now I didn’t need an all-singing and dancing CRM that costs the earth, it just needed to be easy and intuitive to use, allowing me to create automations, tasks and deal flows.

If you’re ever looking for an incredible tool, that is cheap and cheerful, Product Hunt is usually the place to look. It’s full of start-ups that are trying to build a customer base, so you can find quality tools for a pretty reasonable price. That’s how I found Wobaka CRM.

Now all of my investor outreach can be streamlined and managed from one place, giving me the time and head space to prepare for conversations with potential investors instead of fumbling around trying to remember who I need to follow up with and when.

HOW TO FIND INVESTORS QUICKLY: If you're looking for investors, LinkedIn and Crunchbase are about to become your new best friends. There are a few ways you can go about building a list. 1) Simply search for the people with 'investor' or 'angel' in their job titles or LinkedIn titles. 2) Find people that you have a good relationship with on LinkedIn, go through their connections and look for potential investors that you can get a warm introduction to. 3) Look up companies that have a similar product to your own on Crunchbase and look at who invested in them. All of these hacks will help you to continually build a list as you start the outreach process. WIN 2️⃣: Warm intros requested and well-received by 2x people ✅

In last week’s newsletter, I shared some great advice from Alfie Marsh (who closed a $500k Angel round in 12 weeks) — he recommended asking for warm intros, to relevant investors, from your existing network. Mainly as warm intros 1) put you in front of potential investors faster and 2) allow you to ride the tailcoat of your contacts’ reputation (e.g. if the investor values their opinion, they’ll assume the call/meeting is a good use of time).

I was very fortunate that someone had already reached out to me and offered to help me with some introductions, but I’ll have to get to work if I want to hit that 100-120 conversation target. So, I made a list of 10 or so people that I felt comfortable with asking, and started to reach out to them.

Of the three people I reached out to last week, one person outright agreed to help, another was happy to have a call to discuss and the last person offered me some incredible advice, but didn’t really respond to the intro request. That’s a pretty good response so far and, gives me something to build on as the weeks go on.

TIP FOR REQUESTING WARM INTROS: You'll likely have 2x types of people in your network: 1) those you're very close to and can outright ask if they will introduce you to potential investors OR 2) people who are super connected but you haven't interacted with in a while. For the latter, don't ask them for intros via email or messenger, ask for a call so you can explain in person. Tone of voice and facial expressions go a long way in giving people the right impression. Also, ask if they feel comfortable with making an introduction and make it clear that there is no pressure or hard feelings if they say no. This is a building block in establishing a good relationship with someone, so give them the space to say no without discomfort. Finally, if they're sitting on the fence, ask if they want to see your pitch deck or do a dry run of your pitch. That will give them some reassurance that you're ready to speak to their contacts as, the reality is, their reputation is at stake if you fluff it up. WIN 3️⃣: Got some incredible advice from Founder communities ✅

There are so many online communities for Founders these days, it’s often pretty easy to jump into one and get great advice from people who have fundraised or invested. Last week, I joined a Telegram group set up by Andy Ayim, Investor and Founder of the Angel Investing School and he shared 5x ways to find Angle investors:

Attending accelerator demo days to network with Angels

Searching Sifted, TechCrunch, UKTN and other media outlets by looking for keywords like ‘angels’

Reports from establishments like the Founders Factory, who have created a list of the most active Angels in the country

Databases like Crunchbase and Pitchbook (more tips in my hacks section)

LinkedIn, look for connections who have 10-20 years of experience and are Directors, VPs, MDs as well as that kind of role at large companies

This was all super valuable advice that I applied while building my investor outreach system. Options 1, 4 and 5 are also tasks that you can repeat on a weekly basis to keep building the outreach list as you go along.

ADVICE ON FINDING GREAT COMMUNITIES: Speak to people; ask Founders for referrals to online communities that they trust and have helped them in the past. Also reach out to people that you value on LinkedIn. After sending a connection request on Andy on LinkedIn and asking for some advice, he kindly sent me the link to his Telegram group. Sometimes all you need to do is ask. WIN 4️⃣: Applied for the #RukaMakingHistory £10,000 grant ✅

The beauty of building and fundraising in public is, people will see things, think of you and send them your way. Last week, someone let me know that Ruka Hair, a UK-based beauty start-up, launched a competition for small Black-owned beauty businesses to receive a £10,000 grant.

All I had to do was complete a short application form and post a video on TikTok or Instagram telling people, 1) who are we and what we do, 2) what we need the grant for and 3) what are we doing to make history. Here’s how the video turned out

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

I’m not a huge fan of being on camera 😭 but off I went, into the depths of TikTok to post my first video. At first, I tried to freestyle the video (but that went horribly wrong), so I started to make some notes, draft what I would say on camera, and did 8-9 runs before finally landing on the version that I posted.

It was actually a pretty good way to get used to sharing my elevator pitch and quickly demonstrating the size of the problem that Mane Hook-Up is trying to solve. Time definitely well spent.

TIP FOR ENTERING COMPETITIONS: Before starting an application, think about why the judges have asked you to answer particular questions. For example, one of the questions that came up in the Ruka application was 'how will the £10k grant help you?'. To me, this question is about understanding whether the entrants will put the money to good use and have a specific use case for it. So, I quantified my answer by sharing our next milestone of acquiring 1,000 paying customers. If you understand why they are asking you the question, it puts you in a better position to give a concrete answer and stand-out from other entrants who may not have considered what the judges need to see.WIN 4️⃣: Got into the Bag Drop event as an attendee ✅

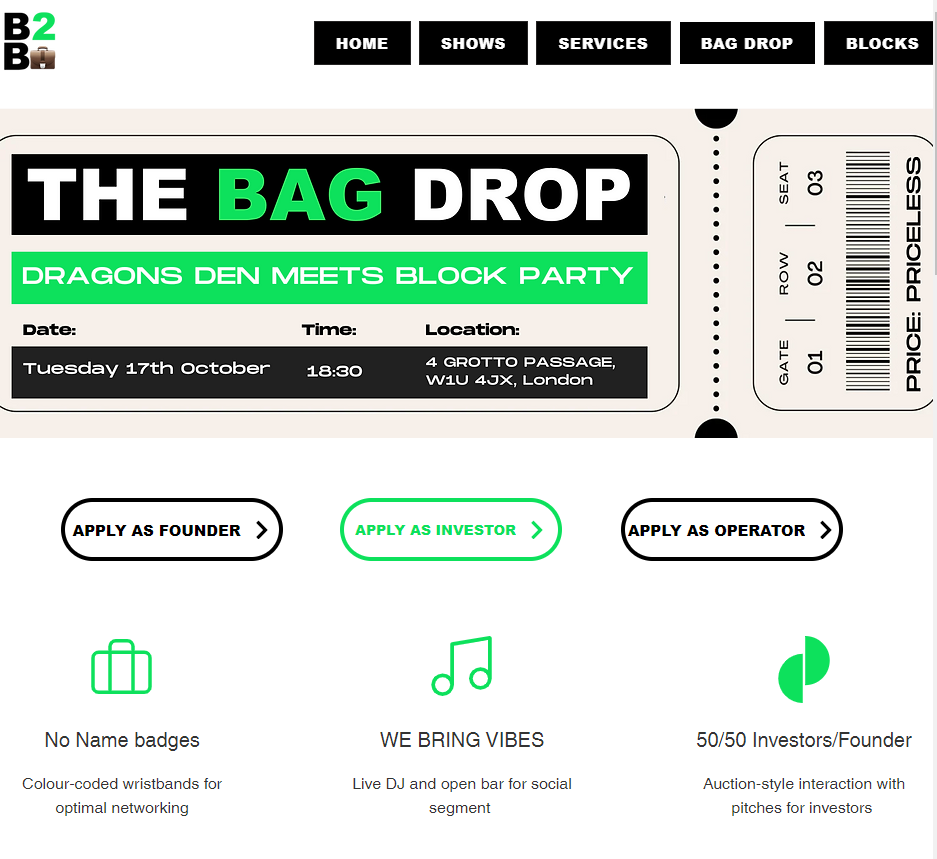

Another win from a Founder community that I love (this came from Kevin Withane’s Diversity X WhatsApp group) — when a member shared a link to The Bag Drop event.

This is a great opportunity to mingle with investors but it was an apply/invite-only event. Five lucky Founders even have a chance to pitch directly to investors in a Dragon’s Den-style set-up.

I applied, got a Founder ticket and off I’ll go this evening to speak to as many people as I can. Another win that I wouldn’t have been able to benefit from had I not been in this community to begin with.

Other things I managed to get done this week:

8x calls booked in with Founders, community members and potential investors

SEIS application submitted! I’ll get an update in 2x weeks

Had 2x amazing catch-ups with my advisors about the next steps for fundraising

TIP FOR EVENTS FOR INTROVERTS: If you're an introvert, like me, events can be more energy draining than energizing. But if you have a major event to go to and need to bring your A-game, get the rest you need and try not to do anything intense before you get there. How you feel will quickly rub off on other people and its important to put your best foot forward when meeting potential investors for the first time. Is this helpful? Share the 240 Days newsletter with your community.

Biggest L’s 🤕

LOSS 1 😩: Had a tough conversation about being a solo founder

During one of the many interesting conversations I had last week, I got a bit of pushback about my decision to be a solo Founder.

It’s not the first time this has come up and, while I can definitely see the benefits of finding a co-founder, I don’t think fundraising should be the sole reason for someone to go down the path of looking for one. I sense that this is one of the reasons why there are dysfunctional Co-Founder relationships.

Finding a Co-Founder is a bit like deciding to get married. When you genuinely want to look for a partner, know what you need and are intentional with your search, you (hopefully) find your forever person. But, if you look for a partner for convenience, pressure or just because you just don’t want to be alone well… that’s the beginning of a bad situation.

Now, don’t get me wrong, I totally understand why investors like to see at least 2x Founders in the mix. It’s less risk, more workload divided and there may even be statistics to prove that it increases a start-up’s likelihood of succeeding. But the thing that isn’t said often enough is the likelihood of success also strongly correlates to both Founders being a good fit for each other.

There’s part of me that wishes this desire to see more than one Founder wasn’t as big a deal as it is. But, it’s just one of the many realities of fundraising that I have to be prepared to face.

LOSS 2 😩: 2x investors replied to my pitch to let me know Mane Hook-Up isn’t the right fit for them or the fund

I know that not everyone I speak to will think Mane Hook-Up is a good fit for them and that’s not always a bad thing. Often these conversations can lead to investors nudging you along to someone else who is a better fit, which is a great result. But, I actually found not getting feedback more challenging than the outcome.

As someone who likes to constantly improve, I didn’t know if this was purely ‘the business isn’t right for us’, or if there were things I could be doing as a Founder to present the business — or even myself — better. This is another reality of fundraising that I’ll probably have to adjust to, but it highlights why finding people to offer feedback on my deck or my pitch is so important.

LOSS 2 😩: Our amazing intern got a job offer and is moving on (after just 3x weeks)

Note: I’ve cheated here as this is a loss that led to a win 🤫

Internships help people to get experience that puts them in a better position to land a good job. But I didn’t expect the person interning for me to nab one oh so quickly. In the middle of last week — just 3x weeks in — she let me know that a new job was on the horizon. Super super happy for her and we’re going to stay in touch to see if there are projects we can work on in the future. Despite it being a short run, she was absolutely incredible and I appreciate all of the time that we got to work together.

On the flip side, this meant looking for another person to step into the Marketing & Opps role. I was fortunate to have 100+ people apply for the role and interview 10 great people.

My mentor, Jeremy, gave me the bright idea to go back and speak to anyone else that I would have happily offered the role. I did. She accepted and is starting this week 🥳

TIP FOR ANYONE THAT'S HIRING: Anyone that's recruited has said 'let's stay in touch', and while it's usually said quite flippantly, I highly recommend keeping your word and checking in with people who are potential super candidates. An email once every 4-6 months is more than enough to let them know that you meant what you said. It can open the door to you going back and re-opening conversations later. 💡 Lessons learned

Quote of the week

Growth and comfort do not co-exist — Virgina Rometty

LESSON 1 👩🏾🏫: Reverse engineer the investor outreach process, it will save you time and missed opportunities

I’m a big fan of reverse engineering an objective or a problem. When it came to investor outreach, this meant asking myself what processes needed to be in place for me to successfully speak to 100-120 potential investors.

Starting with that question stopped me from going down the ‘spray and pray’ approach, and helped me to create a considered process that identifies whether investors could be a good fit, who can help me connect with them and how to stay in touch regularly.

Doing this will also make you realise how important it is to build a network of people that you can rely on and, equally, can rely on you. Last week, a VC told me you have to be good at fundraising to win. I didn’t quite understand what he meant at the time, but I think I do now. The fruit only comes to pass when you have proactively been networking and building relationships with people over time. The culmination of interactions you have, support you’ve offered, goodwill you’ve given and good things that people have to say about you, all lead to the end result of the round you raise.

My most valuable piece of advice to people who are considering fundraising in the next 2 years is to start building those relationships NOW. Speak to Angels, VCs, Scouts and high-networth individuals before you are ready for the money. That way, when you are, it will be a lot easier to find.

LESSON 2 👩🏾🏫: Do investor research and due diligence before reaching out

Imagine being an investor, and people openly knowing that’s what you do for a living.

Now imagine how many LinkedIn messages and emails they get a week from Founders.

Finally, imagine how many of those emails and messages are about products you’re really not excited about because you focus on a particular industry (e.g. health tech or food) or product type (e.g. B2B SaaS).

This is why research is such an important part of the investor outreach process. Yes, as a Founder, you want to speak to as many people as possible. But there are enough investors in the world for your search to be targeted.

Here are some things to consider before reaching out:

Are they the right kind of investor? (e.g. Angel, VC, family office)

Do they invest in businesses in your location?

Do they invest in your sector or product type?

Do they focus on supporting particular groups of founders? (e.g. women, people of colour, underrepresented groups)

Are they likely to offer money and support or just money?

This thinking should also help you to understand what your ‘ideal’ investor looks like. That way, the conversations that you have will be more valuable for everyone involved.

💥 Hack of the week

How to find angel investors contact details on Crunchbase (without paying a dime 🤑)

Crunchbase is one of the most well-known online databases of companies across the globe. And it’s a great tool to gather information and contact details of angel investors and VCs… for free. Here’s how you can go about it:

Head to Crunchbase and create an account

Start searching for contacts to make a list of investors — eventually, you’ll max out the number of searches you can make and Crunchbase will ask you to upgrade to see more people

At this point, they’ll offer you a 7-day free trial — go for the Pro option — and enter your card details. All you need to do is cancel before the trial is up.

Next, Crunchbase will offer you a chance to use their Contacts features, also free for 7 days. Add that to your account as well.

Hey presto, you now have a way to get the contact details of investors for absolutely nothing — for 7 whole days.

Now, unfortunately, you can’t just search for an investor and grab their details. You have to find them via the company search. Just type in the organisation they work for, then search their name, before adding them to a list and exporting their details into your CRM.

If you’re not sure how to get the contact info, here’s a very quick Loom video

How to get contact information on Crunchbase - Watch Video

📚 Resources

If you made it all the way to the end of this newsletter, you deserve a reward. So here’s a list of the best resources I came across last week to help you with your raise.

Templates to use

The Investor Research template that I created to information gather and prioritise the investors I get in touch with. It’s a Google sheet that you can just duplicate

Angel investor lists

Communities you should be in

Andy Ayim’s Telegram Group — some great tips and advice in here.

Diversity X WhatsApp group (for underrepresented Founders, get in touch with Kevin Withane to get access

Founderland — for women of colour founders based in Europe

Platforms that connect start-ups with investors

Signal FX — this requires a bit of work as you have to ask people in your network to connect with you on Signal as well, but is worth the hassle.

Go Global World (you can also get a 75% discount on membership fees)

Floww — I haven’t used Floww yet, but worth checking out as they seem to connect Founders that are raising with investors too.

🧰 Founder’s toolbox

Anyone who knows me knows that I love finding tools, apps and systems to add to my arsenal. Each week, I’ll share 1-3 tools that I’ve added (or removed) from my toolkit and hopefully, they’ll serve you well too. Here’s a list of the best tools that I found last week…

Wobaka simple CRM

What’s it for: Anyone that needs to do customer outreach and manage their sales process or outreach of any kind really.

How it helped: I’ve used Wobaka for my investor outreach process and it also works a dream. You can create simple automations, tasks, and manage contacts in a pipeline.

Price: $19 a month per user

Rating: 4.5/5*

Slidebean for pitch decks

What’s it for: Building a well-designed, interactive, online pitch deck (it can also be downloaded as a PDF or PPT).

How it helped: Helped me to build and iterate several versions of my pitch deck. With Slidebean, you can also create private links to decks that can be shared with specific people (and also be switched off when you’re ready). Slidebean also runs an agency, and you can get support from their team to build or tweak your deck. I haven’t used this service, but it looks like they know their stuff.

Price: $199 a year (this includes access to financial models, investor tracker and other neat tools).

Rating: 4.5/5*

Questions? 🤔

Feel free to drop any questions in the comments below! Until next week,

J x

P.S. Here are some of my other posts:

P.P.S. Enjoy this newsletter? Subscribe and please share with a friend who could benefit from reading it!